How Mutual Funds Works

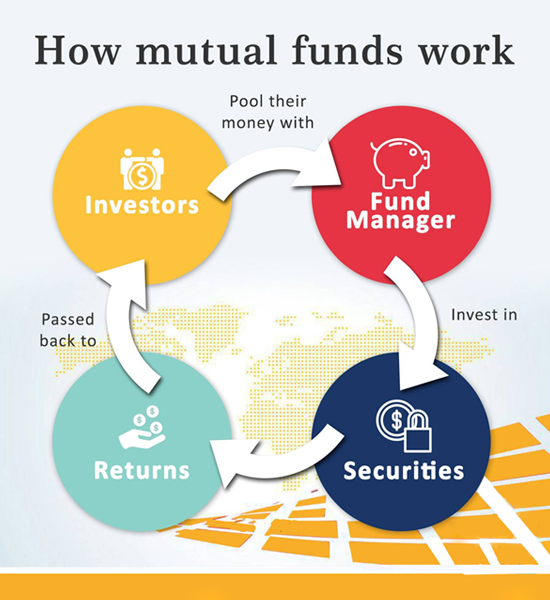

Mutual fund is an investment vehicle that pool the saving of a large number of investor and invest it in various securities in line with their common financial goal . Each investor owns units, which represents a portion of the holdings of the fund.

A mutual fund gives you an option to either receive your earnings in the form of dividend, or to let the same accumulate in the fund through the growth option. In that case, the unit price called NAV increases, and you may redeem the profit by selling of a part or all of your unit holdings.

Advantages:

- Portfolio diveersification – leading to reduced risk

- Professional management

- Small investments possible

- Liquidity

- Transparency

- Convenience and flexbility

- Low transaction costs

Formula of A B C D

- Asset Allocation

- Balancing based on market valuation

- Change in business cycle

- Discount - strategies avaikable at discount

| No Instrument Available Which Give return guaranteed | 12% | SWP - This also does not give guarantee but with past return of last 30 year this has been assumed as bench mark. |

| No Instrument Available which give return Guaranteed | 16% | SIP - Here also if you really want to be generate this, return, the only things required is Saggregationof funds into Small cap, Mid cap, Large Cap, Multi Cap etc. |

| No Instrument Available which give return Guaranteed | 20% | This Signifile the investment in direct equity, share market, inline trading, but as expert we advice to put only the money here. Which if incase becomes zero we are able to sustain tha losses. |

- Equities have been giving a return of around 17% over a block of 10 years for the last 35 years.

Get free consultation

© Copyright 2012 - 2026 All Rights Reserved